Buy now, pay later - for buyers & suppliers

Do you want to extend the credit period on your supplier invoice, or boost your sales by offering flexible payment terms to your B2B customers?

quickpaid offers smooth solutions for both!

Our financing solutions

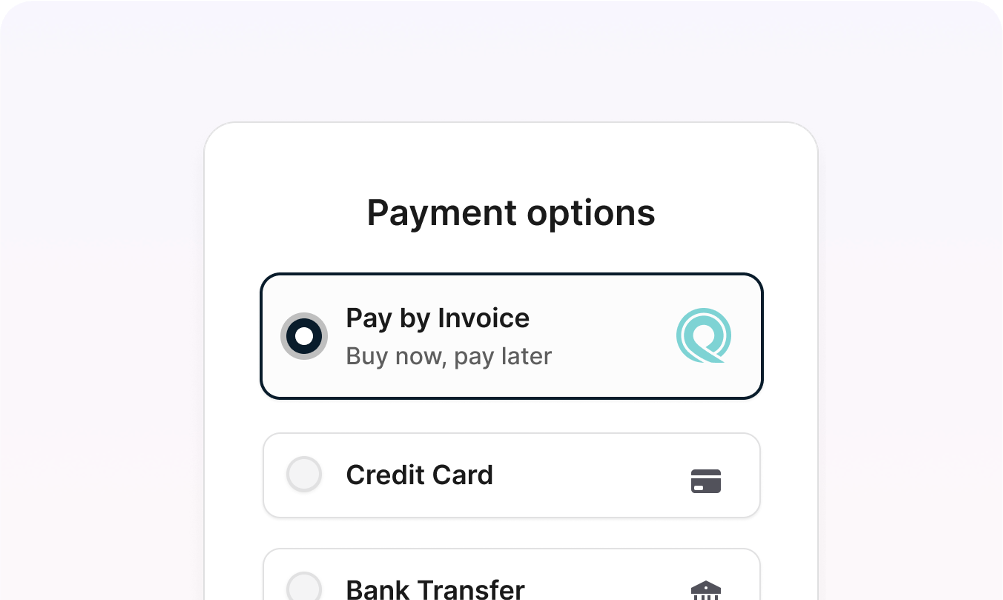

Pay later

Increase both conversion rates and the average order size by offering flexible payment options.

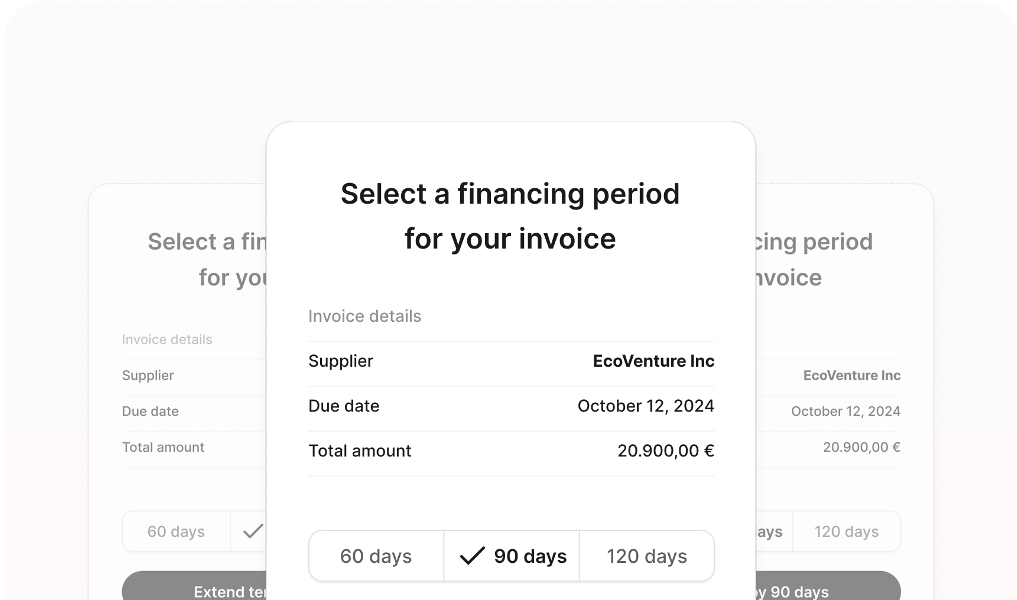

Purchase financing

Buy the goods or services your business needs without stress. We pay your suppliers, you pay us up to 120 days later.

quickpaid in numbers

Million EUR financed to SMEs

Customers & suppliers funded

Supplier invoices financed

What our customers say about us

Nicolay Ofner

"The use of the portal is very simple and uncomplicated, since only the invoices to be financed have to be uploaded and no additional securities or guarantees have to be deposited."

Wolfgang Niemeyer

"I particularly appreciate that the outflow of liquidity does not occur until we have generated sales and this income with the purchased goods ourselves."

Ernst Vasterling

"This product absolutely hits the "nerve of the time" among entrepreneurs who are looking for innovative and powerful financing solutions in the short and medium term, detached from traditional ways."