Flexible payment options to your customers, immediate payment to you

Empower your customers by offering them the flexibility to prolong their payment terms up to 4 months – while you get paid right away.

Boost your average order value

Attract new customers more easily and avoid missed sales opportunities. Remove the barrier to larger purchases by offering your customers a smooth ‘Pay Later’ service – up to 4 months.

Delivering BNPL for all sales channels

and touchpoints

No matter the sales channel — on-site, phone or online, quickpaid equips your sales team with flexible payment options to maximize every customer interaction.

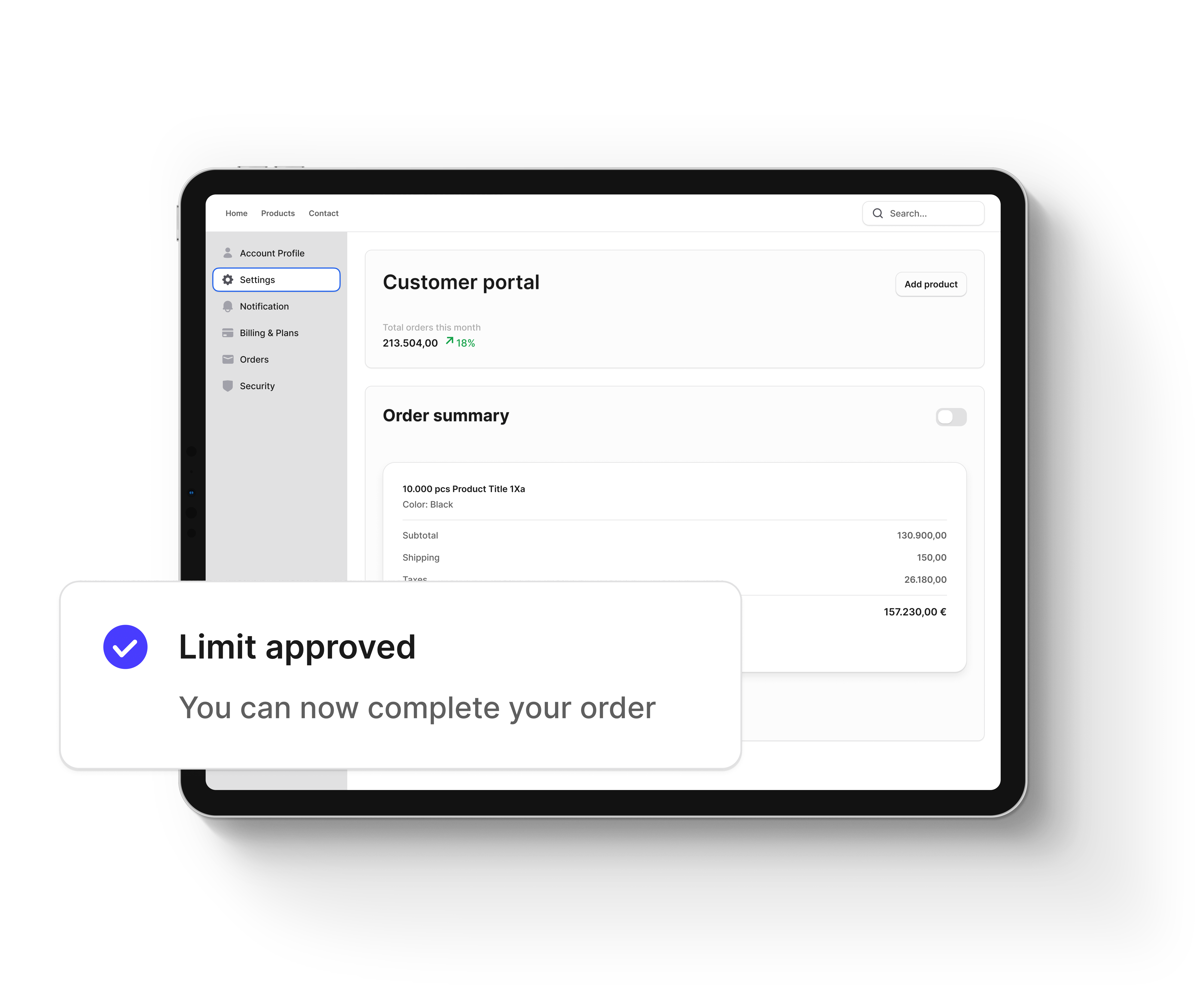

Easy to start - Easy to use

1

Your customer places the order.

2

We instantly assess your customer and grant the credit line.

3

Your customer chooses payment terms: 60, 90, or 120 days. You get paid immediately, and quickpaid takes the risk and handles payment collection.

Longer payment terms without risk

You get the full invoice amount right away, whether or not the customer successfully pays.

quickpaid takes on the full payment default risk. We underwrite and run credit checks on your customers, to mitigate your risks and reduce your workload.

No complex integrations needed.

Get started and offer quickpaid to your customers right away. We understand your customer journey and tailor the integration that would work best for your business.

With quickpaid, you can offer ‘Pay Later’ options – without any costs to you.

Got any questions? we’re here to help

quickpaid Sales financing is our Buy-now-pay-later solution for B2B invoices. With our BNPL solution, you can offer your business customers the flexibility to prolong the payment terms up to 4 months, while you get paid right away. Never miss a sales opportunity again.

With quickpaid you can offer flexible payment options to your business customers, lowering the barrier to larger purchase and in turn, boosting your sales. Furthermore, with quickpaid Sales financing you can attract new buyers, increased customer loyalty and retention.

You get the full amount of the transaction right away, improving your cashflow and reducing your credit risk

You get the full amount of the transaction right away, whether the customer successfully pays or not. quickpaid takes on the full credit risk.

Get started right away, our team is here to assist you.

Mail: sales@quickpaid.com